Making collection calls is no fun. In fact, some companies let their past due accounts pile up simply because debt collection calls are awkward and uncomfortable, making it really easy to put off or avoid completely.

In a previous article, we showed you how to write the second collection call script. If you still haven’t received payment from your customer, it’s time to make one last call to request a resolution before sending them to a collections agency or taking legal action. Read on for our thoughts about the right approach and how to write the third collection call script.

Writing the Third Collection Call Script

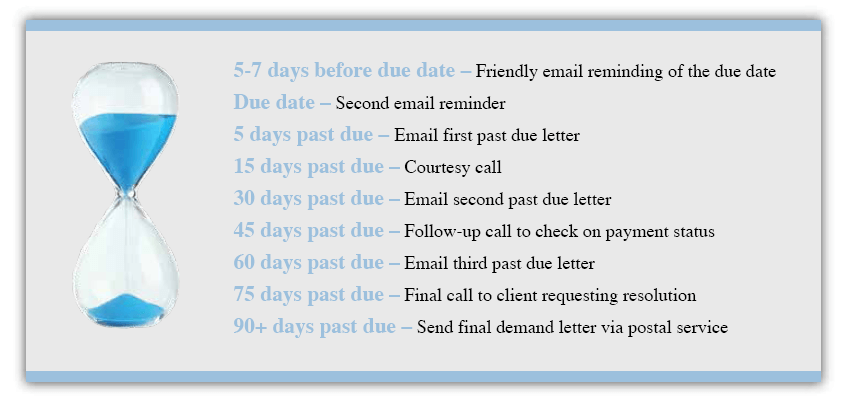

If you’re following the collections strategy we’ve outlined in previous articles, the third collection call (also known as a final demand call) is usually necessary when the invoice is about 75 days past-due.

You've done everything you can to resolve this overdue invoice. Emails, letters, calls – all done politely and professionally – but you still haven’t received payment. Before picking up the phone to make this final call, you’ll need to prepare meticulously.

With that in mind, here's a script that might help you prepare for a third collection call:

Hello, [client’s name]. This is [your name] with [your company name]. I’m calling again regarding [invoice #__________] for [$ __________]. This account is now significantly past due. I hope we can resolve this account today because otherwise we must refer you to a third party, which can negatively affect your credit rating. Let’s work together to avoid that.

Note: If a payment plan is established during this call, secure a partial payment before ending the call.

Call Notes and Strategy

You’ll probably notice this third and final call script is shorter than the others. That’s because you’ve already sent multiple letters, called multiple times, and heard all the excuses by now. The primary purpose of the third call is to make one final demand and communicate clearly what you intend to do next.

As with all collection calls, be prepared to take notes including details like who you spoke to, their role in the company, what you discussed, the reasons and details they provided for lack of payment, and any agreements or promises made during the conversation. If you eventually pass the account to a collections agency, every contact attempted or made must be documented and – if it goes far enough – provided as proof in court.

If you’re following the collections strategy we’ve provided in previous articles, you’d be making this third collection call (or “final demand” call) about 75 days after the due date.

In fact, here’s a cheat sheet for collections timing best practices to use as an example of a typical approach your company might use:

💡 TIP: Accounts Receivable and Collections software like Collect-IT helps document all customer communication, manage template collections letters and call scripts, and standardize the timing of your reminders to help take the stress out of collecting payment on past due invoices.

Common Excuses and Solutions

Honest mistakes aside, you must view non-paying customers as organizations willing to use your money to fund their business. This is a growing trend among larger companies that use smaller vendors as a source of cash flow for operations.

Following are the three most common games customers sometimes play to avoid paying their invoices and how to handle them:

1. They claim they forgot

“Oh, that slipped my mind” or “We forgot to enter that invoice into our payables system.”

Solution: Be proactive and consistent. Send reminder notices of upcoming due dates before invoices are due. Notices at least 5 days before and on due dates will make a difference.

2. They state that can’t

"I can’t do it" or “I give up.” These are terms you never want to hear, as they may signal a customer is headed for bankruptcy.

Solution: Don’t let it get that far. Monitor your clients and look for warning signs. If their balance grows uncharacteristically large or they suddenly switch to another payment method, your client may be heading toward trouble. Help them find ways to meet their commitments.

3. They test your boundaries

Sometimes customers test your boundaries to determine what you’ll tolerate and in some cases, simply refuse to pay or state, "You can’t make us pay."

Solution: Deal with it head-on and be consistent. Create your collections strategy and stick to it. If your strategy states that a call is needed any time an invoice is 15 days past due, make that call. Customers may pay just to avoid talking to you. If a customer says they won’t pay, it may mean they’re unhappy. Determine the problem and correct it.

Finally, if no other solution exists, take away their purchasing privileges. If the client still doesn’t honor their commitments, legal action may be needed.

Want More Tips, Templates and Guidance Like This?

Click below to download our Ultimate Guide to AR Collections where you'll find 27 pages of expert advice, best practices, industry benchmarks, and loads of letter templates and call scripts.