In our previous article in this series How to Write Reminder Emails, we talked about the importance of customer communications and providing courtesy reminders before the invoice is due. These simple reminders are enough to get most customers to pay invoices on-time. But when an invoice payment falls behind, it’s time to take a different approach. Read on to see a sample of how to write the first collection letter (also called a dunning letter).

Setting the Right Tone

If you’re following the strategy we’ve outlined so far, you’ve sent two reminders with the invoice attached before the due date (in addition to sending the original invoice).

However, it’s important to keep in mind that at this point invoice is still barely past due. It could be that the customer simply forgot to pay or someone in their accounting department was out sick or on vacation. Whatever the case, it’s important that the tone of your letter or email matches the situation in which the invoice has gone just a little bit past due.

If the invoice remains outstanding for another 30, 60 or 90 days, the tone of subsequent collection letters will change and become more stern. But for now, keep it somewhat light and focused primarily on reminding the customer that the invoice is due.

First Collection Letter – Past Due Notification

Here’s a sample of the first collection letter (aka dunning letter) you might send to a customer as soon as the invoice has gone past-due:

Dear <Name>,

Just a reminder that invoice number <Invoice_Num>, which was issued on <Invoice_Date> for $<Invoice_Total>, is now past due. A copy of that invoice is included with this communication.

If payment has been issued, please contact <AR_Rep_Name> at <AR_Rep_Email> or <AR_Rep_Phone> to provide us with the payment information so we may properly notate your account. If payment has not yet been made, we accept check, credit card, ACH, and wire transfer, and encourage you to make a payment today using one or more of those methods.

As always, we appreciate you as a valued customer and look forward to our continued relationship.

Sincerely,

<Signature>

Note the following in the letter sample:

- Details including invoice number, date, and amount

- Clearly state that the invoice is past due

- Provide payment options and desired next steps

💡 TIP: all written communication (email or letters) sent throughout the accounts receivable and collections process should include copies of the invoice(s) in question.

A/R Collections Timing and Best Practices

Using letter and email templates are a vital aspect of an automated and effective collections strategy. They allow you to standardize your approach so you can test and refine different variations of emails and letters to determine which version is most effective.

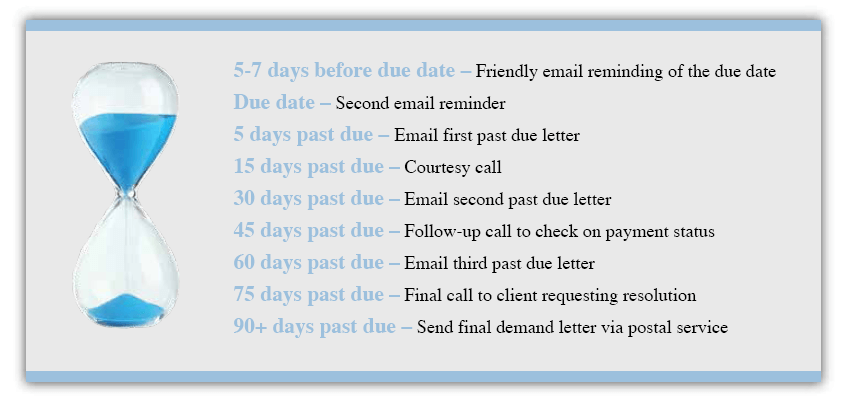

In addition, we recommend that you standardize the timing of your reminders and collection letters/calls. In fact, here’s a cheat sheet for collections timing best practices to use as an example of a typical approach a company might use:

📝UP NEXT: Be sure to check out the next article in this series:

How to Write the Second Collection Letter.

Want More Tips, Templates and Guidance Like This?

Click below to download our Ultimate Guide to AR Collections where you'll find 27 pages of expert advice, best practices, industry benchmarks, and loads of letter templates and call scripts.