Every business has customers with a history of paying late. But if you’ve been in business long enough, you also realize that the longer an invoice goes unpaid, the less likely you are to collect anything at all for the products or services you delivered. That’s why we want to provide these 10 best practices that will improve your credit and collections efforts, while maintaining a healthy cash flow and low Days Sales Outstanding (DSO).

1. Review Customer Credit Ratings

The most common way to evaluate credit worthiness is by pulling customers’ credit ratings from a credit-monitoring firm; popular firms include NACM, Dun and Bradstreet, Experian, and Equifax. One of the oldest and largest credit-monitoring firms is NACM National Trade Credit Report. Their report offers an on-demand predictive score and risk rating through your accounts.

These firms allow you to check credit on an individual busienss, a subset of businesses, or your entire customer portfolio. If you want your customers’ credit ratings updated on demand and available immediately for credit worthiness decisions, select a credit-monitoring firm that integrates with your accounts receivable or collections software.

2. Set Goals for Uncollected A/R

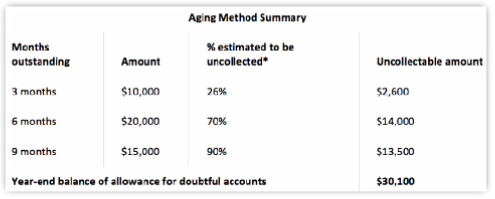

Use the aging method to estimate uncollected accounts receivable. This method calculates the projected sales by month and decreases revenue by the percentage of uncollectable sales. You could use an aging schedule like the example below, or one that’s developed for your specific industry.

The sample chart below is based on the aging method and shows that in general:

- 26% of invoices 3 months old are uncollectable

- 70% of invoices 6 months old are uncollectable

- 90% of invoices 12 months old are uncollectable

*Percentage estimated to be uncollected according to The Accounting Minute by Sutherland.

Needless to say, taking time to develop and implement standards, policies, and procedures that focus on collecting payment within 90 days is critical.

See Also: AR Metrics Every Company Should be Tracking

3. Rate Your Customers

Rating your customers allows you to approve credit and monitor balances to avoid credit problems from the very beginning. As we covered in a previous article, one way to think about customer ratings is similar to comparing types of cars (i.e. a Mercedes-Benz SL Roadster versus a Ford Pinto).

In very simple terms, you might rate your customers in the following way:

- A or prime: Almost always prompt; likely require little monitoring

- B or good: Usually prompt; collections efforts may also be minimal

- C or limited: Requires regular monitoring of balance, credit line, and past due amounts

- D or marginal: High-maintenance accounts, requires constant scrutiny, limited credit terms

- E or COD only: No terms or pre-paid only, as determined by credit

4. Send Invoices Promptly

Send invoices daily or as soon as the customer receives the product or service. A mistake that some companies make is to batch and send all invoices on a specific day of the week which tends to add 3-5 days to the collections cycle, unnecessarily.

5. Prominently Feature Terms and Due Date on the Invoice

Leave no room for misunderstanding by clearly spelling out the terms and due date in bold letters directly on the invoice. If a customer consistently pays late by the same number of days, speak to their accounts payable department to go over the terms on your vendor account and correct them as needed.

6. Encourage Customers to Accept Invoices Electronically

Emailing invoices and sending them electronically (EDI) will not only reduce your processing costs (printing, handling, postage, etc.), it also reduces processing and delivery time for you and your customer.

7. Offer Several Payment Options

Offer several payment options so your customers can handle their own cash flow while still paying your company what they owe. Especially in this day and age of electronic transfers and bank-to-bank processing, cutting a check or putting it on the company credit card are no longer the only payment methods available. The more options you provide to your customers, the more likely they will pay you on-time.

8. Deliver Invoices to the Right Contact

Often times the person you communicate and do business with is not the person who handles accounting and payments. It’s important to make sure your invoices are going to the right person at the right location to avoid delays in processing.

9. Know Your Customers’ Approval Processes

Getting familiar with your customer’s payment approval process can help you determine where your invoices might be getting stalled, and help guide your delivery method or destination/recipient to improve processing speed.

10. Send Reminder Emails Before Due Date

Send a friendly email – about 5 to 7 days before invoice payment is due - reminding the customer that the due date is approaching. This simple procedure is often the difference between on-time payment and a weeks-late payment.

When doing so, it’s also a good idea to:

- Attach a copy of the invoice

- Provide a contact person for the client for discrepancies/disputes

- Advise the client of the accepted payment methods

Bonus Tip

Perhaps the best thing you can do to get paid on-time is to implement an automated accounts receivable management system like Collect-IT. With Collect-IT, you can build your credit policies right into the software, rank your customers, send invoices and reminders, manage communications, store your collection letters and call scripts, and simplify the entire accounts receivable management process using the power of technology and automation.

Want More Tips, Templates and Guidance Like This?

Click below to download our Ultimate Guide to AR Collections where you'll find 27 pages of expert advice, best practices, industry benchmarks, and loads of letter templates and call scripts.